*DISCLAIMER*: This website is for educational purposes only. I am not a CFP or financial advisor. Please consult a professional before making any financial decisions.

Budgets: who’s got ’em, who wants ’em

Ah, budgets. The salad section on the menu of personal finance: you might glance at it because you know they’re good for you, but you also know damn well that you’re still going to order those truffle fries when the waiter comes. We all know that budgets are important, but it’s so difficult to stay disciplined. With so many of us on shoestring stipends, monthly spending is likely a huge stressor for grad students. While I can’t increase all our paychecks, it can be empowering to know how exactly you plan to use that money. Below are some tips to help you get started on your budgeting journey.

But I hate budgets! Do I have to?

Yes, you have to. Or rather, you should if you want to get serious about getting a grip on your money. The good news is that there is no one way to budget “correctly”; you have to find what works best for you. There are budgeting systems out there (as described below) that require so little effort, you might even forget that you’re on a budget! The first step of realizing what you actually spend your money on every month is always the most painful (at least it was for me). After that, though, you start to feel a little more confident, more knowledgeable, and more in control of your finances. And even when you slip up every so often (you will), it can be comforting to have a plan to guide you instead of feeling like you’re drowning.

Budgeting and scrimping: an important distinction

People often believe that budgeting will force them to give up all their fun activities. While that is a style of budgeting that works for some people, it doesn’t have to be for everyone. If you’ve ever heard of the Latte Factor (aka: “the reason millennials aren’t rich is because they spend their money on lattes and avocado toast!!”), don’t be fooled. This is just one budgeting strategy that may or may not be for you, and if it’s not, you don’t have to feel guilty about that. In fact, you could argue that there isn’t even a point to budgeting and saving if you can’t enjoy what you already have! If you want to budget for your daily coffee or have money set aside for concert tickets every month because that brings you joy, then do it!

Photo by Towfiqu Barbhuiya via Unsplash, CC0

I also want to clarify that, unfortunately, growing wealth is often not entirely up to you. There is a pervasive tendency within the financial literacy space to put all responsibility on the individual, and while it’s true that building good money habits helps, there are larger systemic issues that are often overlooked. Beyond the classic racism, sexism, homophobia, transphobia, etc. financial institutions just aren’t designed to benefit the average person. The burden of student loans or trying to buy a house makes things much harder for Millennials and Gen Z than they were for older generations. Add sheer bad luck like a layoff into the mix and, while you may have had the foresight to have an emergency fund, there’s only so much budgeting could have done to kept you from that situation in the first place. I think it’s important acknowledge this because I’ve seen far too many “motivational” personal finance gurus making money by blaming people for their financial situations. If you’d like to read more about it, I highly recommend Helaine Olen’s book Pound Foolish (reviewed in NYT here).

Types of budgets

As you might imagine, there are many different budgeting strategies out there. Some are very hands-on, while others are designed to require as little effort as possible. The list below is certainly not exhaustive, but is meant to show you the breadth of options out here. Regardless of the system, savings, whether to build an emergency fund or save for retirement, will be a pretty critical priority. Check out a recent personal finance post on how to start saving for retirement!

Photo by Mediamodifier via Unsplash, CC0

The envelope budget

How it works: Withdraw your monthly spending money in cash, divide it by category, and place each category into a labelled envelope (i.e. Groceries, Transportation, etc.). Whatever you put in those envelopes is all you have to spend on that category for the month!

Pros & Cons: It’s easy to visualize how much money you actually have to spend and it can stop you from impulse purchasing, but using cash exclusively nowadays can be a huge pain as a lot of stores may be card only.

Try this budget if: you have trouble with overspending because of a credit card OR if you think having physical cash to work with will help you stick to your budget.

Percentage budgets

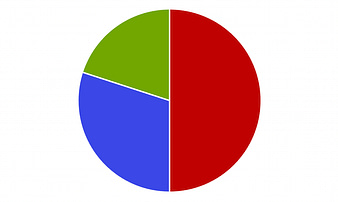

How it works: Decide at the start of the month how you will divide your priorities by percentage. The most common example is the 50-30-20 rule (50% for needs, 30% for wants, and 20% for savings). Needs include things like rent, groceries, or health insurance, while wants may include ordering take-out or getting those really nice sneakers you’ve always wanted.

Pros & Cons: These budgets can be very flexible depending on your priorities. You can include a category for student loans or donations, for example, but it can still be a challenge to keep things on track within each category if you don’t have some kind of budget organizer (see below).

Try this budget if: you want to easily keep track of your savings rate OR you don’t mind working with broad categories like “needs” and “wants.”

Photo by Mika Baumeister via Unsplash, CC0

The Zero-based budget

How it works: This budget doesn’t necessarily tell you how to divide your money, but ensures that every dollar is accounted for. For example, if you had $100 and use $90 for expenses, you can’t just let that $10 sit around: it needs a job! You can do whatever you want with it (allocate it for needs/wants/savings), but it has to go somewhere. Ideally, the net change in your checking account should equal zero at the end of every month.

Pros & Cons: This budget ensures that you are able to maximize the money that you already have. Unfortunately, it can be very cumbersome trying to track every single dollar every single month.

Try this budget if: you don’t mind a good spreadsheet and are more numbers-oriented OR tend to assume that you’ll save whatever is left at the end of the month but never do.

Photo by Brad Barmore via Unsplash, CC0

The Extreme budget

How it works: Extreme budgeting is like a combination of a percentage budget and zero-based budget. Some percent (i.e. 40%) goes towards needs, while the rest (60%) goes towards savings. The distinguishing factor of this budget is that you cut out all unnecessary expenses and wants, freeing up space in the budget for a higher savings rate.

Pros & Cons: Your savings rate will skyrocket if you can stick with it, but cutting out all wants in your life is often too much for most people. It is, as the name implies, pretty extreme.

Try this budget if: you like a challenge and want to build up your savings FAST.

Photo by Igal Ness via Unsplash, CC0

The Reverse budget

How it works: Also known as the “pay yourself first” budget, this strategy prioritizes the timing of saving rather than the amount. When you receive a paycheck, a certain amount should be placed in a savings and/or retirement account ASAP, preferably automatically. The reasoning is that, when you buy things or pay a bill, you’re paying someone else first with money that you worked hard to get. Only after you’ve paid yourself can you calculate how much you actually have for expenses that month, including rent, bills, etc.

Pros & Cons: This is actually my personal favorite budget out of these five and the one I prioritize. It’s great for maintaining a steady savings rate, especially if you can automate as much as possible. Once, you’ve paid yourself, though, there isn’t a lot of guidance on how to budget for other categories.

Try this budget if: you want to prioritize saving, but you don’t want to keep a detailed spreadsheet of all expenses every month.

As you can see, these strategies are also not mutually exclusive! You can have a 50-30-20 split while using the envelope system to track everything, or a zero-based budget where you pay yourself first. Consider what combination will work best for you and your goals.

Important tools you’ll need

A budget organizer

All of the budgeting strategies listed above require some level of organization. You’re going to need a place to write things out and do some basic math to figure out expenses, percentages, etc. There’s no shame in using good old-fashioned pen and paper to do this if that works for you, but I highly recommend using a virtual organizer. The most basic option is just an Excel file – it works perfectly fine if you just want some simple numbers in front of you or if (like me) you like to do the calculations yourself. Other software out there, such as YNAB and Mint, can be connected to bank and credit card accounts to send you alerts if you are over budget, though they sometimes require a monthly fee to access some of the more advanced (and helpful) features. They can also automatically calculate helpful numbers like your net worth, which I’ll get into in a later post 🙂

A list of your “automatable” expenses

Regardless of the type of budget that speaks to you, I STRONGLY recommend automating as much as you can. To do that, you’ll need to figure out what is “automatable.” Utility bills, loan providers, and credit card companies often allow you to set up autopay after connecting your bank account. Depending on your housing situation, rent can sometimes be automated if it is collected online (i.e. if you live in university-subsidized housing). If you have an individual landlord, ask them if they would consider setting up an autopay option.

Because credit card payments can vary, I personally set up an autopay for the minimum monthly payment. Let me be clear, though: if you are able, PAY OFF CREDIT CARDS IN FULL EVERY MONTH. Not paying it off ASAP is a slippery slope to bad credit, insane interest costs, and credit card debt. The autopay is just a precaution in case I forget to pay the minimum for some reason. Even one late minimum payment can drop your credit score more than 100 points!

Of course, all of this depends on you having enough money in your bank account for automatic payments to be made. Keep a close eye on when you receive money and when you’ve scheduled to pay certain bills. Better yet, you can keep a small buffer in your checking account to cover any accidental early payments and avoid over-drafting.

bank accounts that allow automatic transfers (and one that doesn’t)

Automating things between bank accounts will also make your life easier in the long run. If you have a checking and savings account with the same bank, it’s very easy to transfer back and forth, but this is both a blessing and a curse. It’s easier to save money, but it’s also easier to spend the money you just saved. Consider keeping a majority of savings in a separate savings account, one that will take 3-5 business days to transfer into your checking account. Online high-yield accounts are great for this; you’ll 1) earn more in interest and 2) protect your savings when you feel the urge to overspend!

How to stay motivated when you hate thinking about money

Very few of us want money for the sake of money. There’s usually a purpose, like wanting to spend more time with family or travel or pursue a less lucrative passion. Once you find out what your ultimate goal is, it will be a lot easier to put in the effort of budgeting and saving. It’s pretty difficult to be motivated to set aside 10% every month when the account just says “Savings.” However, if it said “Dream Home Downpayment” or “Trip to Barbados,” that might change things.

In conclusion? Try the salad – you might actually like it.

References and Resources

Budgeting Tools

YNAB: https://www.ynab.com/

Mint: https://mint.intuit.com/

Empower (formerly Personal Capital): https://www.empower.com/personal-investors/budget-planner

Personal Finance Education

Nerdwallet: https://www.nerdwallet.com/

Investopedia: https://www.investopedia.com/banking-4427754